reverse tax calculator ontario

Provide a written undertaking to the court stating that you will within six. For amounts 90287 up to 150000 the rate is 1116.

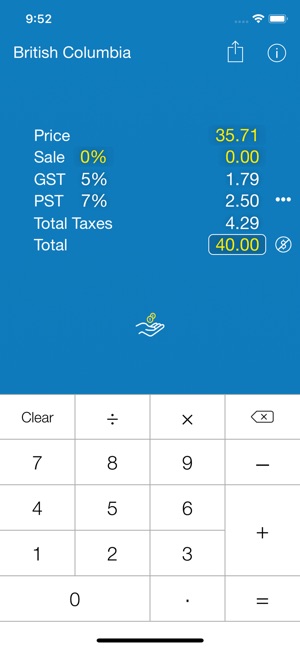

Sales Tax Canada Calculator On The App Store

Formula for reverse calculating HST in Ontario.

. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Ontario Health Preium the Canadian Pension Plan the Employment Insurance. Here is how the total is calculated before sales tax. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

13 rows Harmonized Sales Tax HST The Harmonized Sales Tax or HST is a sales tax that is applied to. The following table provides the GST and HST provincial rates since July 1 2010. If you want a reverse HST calculator the above tool will do the trick.

This is very simple universal HST calculator for any Canadian province where Harmonized Sales Tax is used. Use this simple powerful tool whether your employees are paid salary or hourly and for every province or territory in Canada. Gross annual income - Taxes - Surtax - Health Premium - CPP - EI Net annual salary.

This calculator can be used as well as reverse HST calculator. ADP Canadian Payroll Tax. This simple PST calculator will help to calculate PST or reverse PST.

The rate you will charge depends on different factors see. Amounts earned up to 45142 are taxed at 505. Amounts above 45142 up to 90287 are taxed at 915.

Who the supply is made to to learn about who may not pay the GSTHST. Provincial federal and harmonized taxes are automatically calculated for the province selected. Sales Taxes Across Canada for 1000.

The tax rates for Ontario in 2021 are as follows. Formula for calculating reverse GST and PST in BC. Enter price without HST HST value and price including HST will be calculated.

Where the supply is made learn about the place of supply rules. Calculates the canada reverse sales taxes HST GST and PST. 13 for Ontario 15 for others.

Amount with sales tax 1 GST and QST rate combined100 or 114975 Amount without sales tax. 13 for Ontario 15 for others. HST Tax Rate.

Select the province you need to calculate HST for and then enter any value you know HST value OR price including HST OR price exclusive HST the other values will be calculated instantly. This is very simple HST calculator for Ontario province. Enter HST value and get HST inclusive and HST exclusive prices.

Ontario Basic Personal Amount. Amount without sales tax GST rate GST amount. The payroll calculator from ADP is easy-to-use and FREE.

Ontariotaxcalculator is a simple efficient and easy to use tool in ontario to calculate sales tax hst. Calculating estate administration tax on an estimated estate value. Calculates in both directions get totals from subtotals and reverse calculates subtotals from totals.

Federal Basic Personal Amount. Total After Taxes 5650. PST 8 400 GST 5 250 HST 13 650.

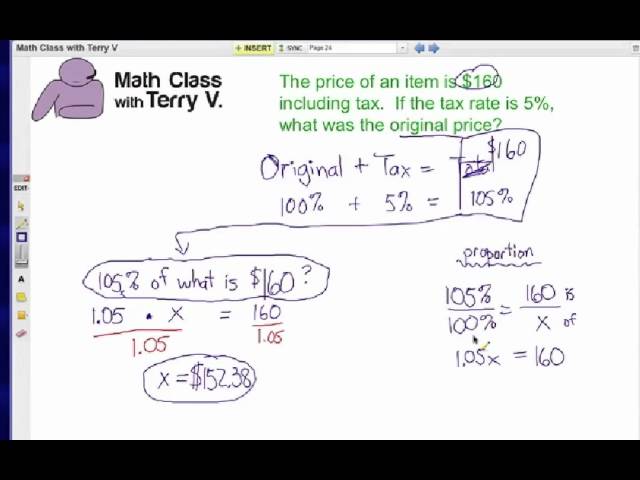

Just set it to the HST province that you want to reverse and enter in the after-tax dollar amount that you want to reverse. Tax Amount Original Cost - Original Cost 100 100 GST or HST or PST. Amount without sales tax QST rate QST amount.

The reverse sales tax calculator exactly as you see it above is 100 free for you to use. Amount without sales taxes x. Here is how the total is calculated before sales tax.

Current Provincial Sales Tax PST rates are. Net annual salary Weeks of work per year Net weekly income. The given number will be the pre-HST number that will be calculated.

Scroll down to use it online or watch the video demonstration. Enter HST inclusive price and calculate reverse HST value and Harmonized sales tax exclusive price. Any input field can be used.

Type of supply learn about what supplies are taxable or not. Amount with sales tax 1 HST rate100 Amount without sales tax. Amount without sales tax x HST rate100 Amount of HST in Ontario.

It is perfect for small business especially those new to payroll processing. Following is the reverse sales tax formula on how to calculate reverse tax. This free calculator is handy for determining sales taxes in Canada.

Use our Income tax calculator to quickly estimate your federal and provincial taxes and your 2021 income tax refund. This is any monetary amount you receive as salary wages commissions bonuses tips gratuities and honoraria payments given for professional services This amount is either 18 of your earned income in the previous year or. GSTHST Calculator Before Tax Amount Reverse GSTHST Calculator After Tax Amount.

Use our simple 2021 Ontario income tax calculator. Earnings 150000 up to 220000 the rates are 1216. HST reverse sales tax calculation or the Harmonized reverse Sales Tax calculator of 2022 for the entire Canada Ontario British Columbia Nova Scotia Newfoundland and Labrador and many more Canadian provinces.

Swear or affirm the estimated value of the estate stated on your application form. Amount with sales tax 1 GST and PST rate combined100 Amount without sales tax Amount with sales taxes x GST rate100 Amount of GST in BC. Ontario Personal Income Tax Brackets and Tax Rates in 2022.

To start complete the easy-to-follow form below. In certain circumstances the estate administration tax paid may be calculated on an estimated value of the estate. Age Amount Tax Credit 65 years of age.

The Retail Sales Tax RST.

For Sale See 23 Photos 6190 Trillium Crescent Niagara Falls On 3 Bed 2 Bath 1350 Sqft House Mls 30798471 Market Niagara Falls Niagara Trillium

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

How To Calculate Sales Tax On Almost Anything You Buy

Want To Buy But No Down No Credit Bad Credit No Problem Classified Ad Bad Credit Bad Credit Score Loans For Bad Credit

Reverse Hst Calculator Hstcalculator Ca

Sales Tax Decalculator Formula To Get Pre Tax Price From Total Price

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Canada Sales Tax Calculator On The App Store

How To Find Original Price Tax 1 Youtube

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Canada Sales Tax Calculator By Tardent Apps Inc

Reverse Gst Hst Pst Qst Calculator 2022 All Provinces In Canada

Using Excel For Tax Calcs Jun 2019 Youtube

Free Oregon Payroll Calculator 2022 Or Tax Rates Onpay

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Sap Sd Reverse Tax Calculation Tax Amount Rounding And Warning Message When Sales Price Is Less Than Cost Price Sap Blogs

Thought Of The Day Think Loan Think Sk We Are With You For All Your Loan Needs All Financial Service Under One R Financial Services Thought Of The Day Finance